Estate Planning – A succession planning for your success…

A key aspect of ensuring continuity of businesses is succession planning. Succession planning is a process for identifying new leaders when existing leaders leave, retire or die. Identifying future leaders early helps prepare them fitting into the role when they become available. It helps businesses retain core values of culture, vision besides ensuring continued financial success.

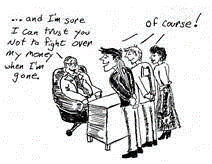

While most business leaders are successful in creating an effective succession planning for their businesses they largely ignore when it comes to planning an effective succession plan for their own personal wealth. Hereditary lines of succession planning is assumed where the inheritance is passed on to a natural off-spring or relative of the grantee. Individuals largely focus on creating wealth for their families and ignore planning for the preservation and smooth and unhindered succession of their wealth. The thought probably is that why worry about what will happen after they are gone, because when they return to dust, they will feel nothing about the wealth or can do nothing about it. If the wealth is created and preserved for the sake of the families, the last thing that one wishes is to be berated by the near ones for making inheritance of that wealth a pain.

While there are a lot of individuals who are extremely good at tracking their investments and other financial transactions related to all asset classes (real estate, insurance, financial instruments) etc, their near ones are kept in the dark largely on the details. Insurance policies by definition are a protection from unexpected expenses due to an ailment or unfortunate passing away of the primary bread winner. Viewing Insurance as an entitlement means an event is foreseen. We would rather have the comfort of the insurance and not get to use it.

Dealing with the loss of near one is difficult and the last thing on the mind is getting a hold of the familes’ financial assets. Ceremonies following the passing away, making arrangements for payment of bills due immediately, ensuring that the expenses for running the house is available becomes a priority. Friends and family cant be depended upon for assisting after the first few weeks. We have seen / heard of numerous examples of a large amount of time and money being spent for ensuring smooth succession of assets. The trouble of operation, administrative delays and paper work required can be at times more painful that bearing the loss of a near one.

The key objectives of proper estate planning are – Ensuring smooth succession without any hinderances or delays, Ring-fence Assets against future liabilities / marital issues and Protecting the Interests of the Family ensuring that health, education and lifestyle needs are met in case of any unforeseen event.

A proper estate plan would entail

• Create a list of all assets – Bank accounts, Investments accounts (Trading and Broking accounts), Insurance Policies, Real Estate Investments (Deeds, Agreements etc). It is important that key documents related to these assets are stored in a safe location (preferably a locker) and family members are aware of the storage location & existence of that list.

• Create a list of all assets – Bank accounts, Investments accounts (Trading and Broking accounts), Insurance Policies, Real Estate Investments (Deeds, Agreements etc). It is important that key documents related to these assets are stored in a safe location (preferably a locker) and family members are aware of the storage location & existence of that list.

• Create a list of Online accounts, Passwords, etc. In the interest of security, these may be stored in a secured place.

• Create a location map for Keys, Jewellery, Expensive gifts or artefacts, Other assets like Pens, Watches

• Having a Nominee (preferably the spouse, an adult child or a relative who will not predecease you). Nominee list can be reviewed and updated periodically and the beneficiary named in a Will or a Codicil supersedes the nominee. Nominee makes the succession transactions easy and is not to be confused as being the ultimate beneficiary.

• Have at least one joint account with the Spouse / Nominee / Beneficiary to ensure proceeds from the investments are received and used without any time lag after transmission of the assets.

• Prepare a Will listing out the beneficiaries and the proportion of assets due to each beneficiary. The beneficiary for each of the assets and the proportion of disbursal need not be uniform and can be decided based on an equitable valuation and distribution of assets without dividing each illiquid asset.

• Key elements of a good will would include the list of all assets – moveable/ immovable, liquid / fixed assets, an executor, the beneficiaries and the proportion due to each, transmission conditions if any of the beneficiary’s pre-deceases the executor, Witnesses, etc.

• While it is not mandatory to register a will in India, it is advisable. It is not advisable to impose conditions on the use of the assets post transmission as it makes the inheritance a complicated and tedious process. The contents of the will can remain confidential and the document itself can be kept in a sealed envelope or deposited with a safety locker.

• Given the large amounts of digital assets – Photos, Email accounts, Social media accounts & Posts, Frequent flyer accounts, Online wallets a Will may include the transmission of assets or nominate an executor who will ensure a proper closure of online accounts so that they may not be mis-used.

• Cover liabilities adequately – Loans and other liabilities may be covered with pure term insurance cover so that the lender does not harass family members.

• Create a Contact list of Bankers, Key employer contacts, Financial advisors, Lawyers, Insurance agents, etc

• It is not a bad idea to create a calendar listing out key dates for payment of insurance premium, taxes – home, income, etc, monthly bills

In the present times, we have seen news on re-introduction of Estate duty / inheritance taxes in India and thus it becomes also pertinent to ring fence against any such erosion in wealth through proper estate planning.

Depending on the value of assets and the desired utility of the same, one may consider creating family trusts

Recommend0 recommendationsPublished in Personal Finance, Uncategorized